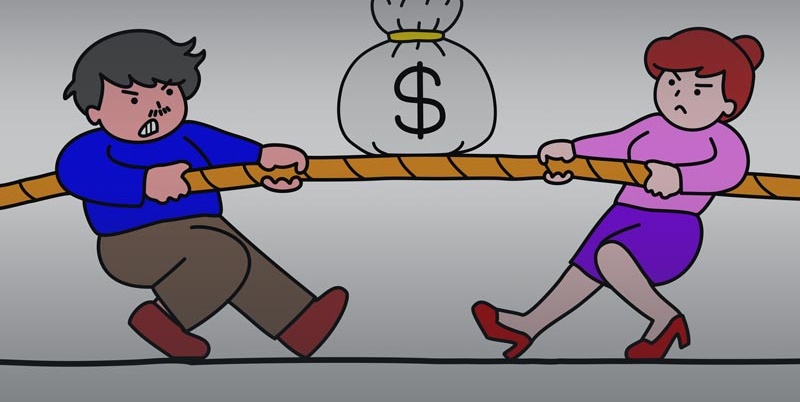

If you hold an asset jointly with an adult son or daughter, such as a bank account or a cottage, you may be surprised to learn what will happen to the asset after you die. Like many parents, you might assume that the asset passes directly to your surviving child and that he or she can do whatever he or she likes with the asset. However, unless you have made your intentions clear, the law will presume that your child is holding the asset in trust for your estate. In other words, the law does not presume that the asset belongs to your child.