Please don’t be mislead by the title to this blog. We are not suggesting that beneficiary designations are to be avoided. Quite the opposite is true. What we actually want to do is highlight the fact that a critical component of estate planning is reviewing your beneficiary designations. What you need to do is ensure that your designations are in sync with the rest of your estate plan.

There are various assets for which you can designate a beneficiary i.e., someone to receive the asset directly upon your death. These include RRSPs, RRIFs, TFSAs, and life insurance products. The designation can be made in your Will or outside of your Will in a separate document. These designations may also be governed by various Ontario and federal laws applicable to the particular asset as well as the specifics of the plan or policy relating to the specific asset.

Most of us know that every capable adult should have a Will. However, for obvious reasons, it is something that often gets put on the backburner as it can be difficult for some to think about. The death of a celebrity passing away without a Will often serves as a poignant reminder of the importance of making sure our own estate planning is done and up-to-date. Recently, it is the unfortunate passing of Prince that comes to mind. It has been reported that he died without a Will leaving behind a $150 million dollar estate.

Most of us know that every capable adult should have a Will. However, for obvious reasons, it is something that often gets put on the backburner as it can be difficult for some to think about. The death of a celebrity passing away without a Will often serves as a poignant reminder of the importance of making sure our own estate planning is done and up-to-date. Recently, it is the unfortunate passing of Prince that comes to mind. It has been reported that he died without a Will leaving behind a $150 million dollar estate.

The temperature in Ottawa has steadily risen over the past week and culminated over the weekend in our first heatwave in May in over 100 years. This steady rise in temperature is matched by a steady rise in residential property sales over the last few years in Ottawa with this spring being no exception.

The temperature in Ottawa has steadily risen over the past week and culminated over the weekend in our first heatwave in May in over 100 years. This steady rise in temperature is matched by a steady rise in residential property sales over the last few years in Ottawa with this spring being no exception.

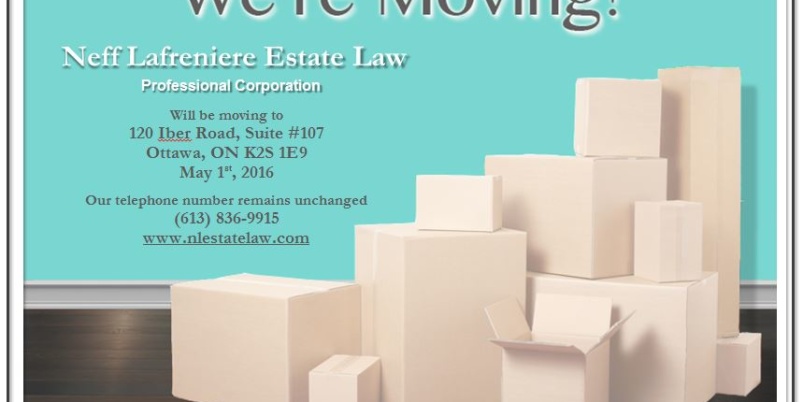

Our big moving week here at Neff Lafreniere Estate Law has finally arrived. We couldn’t be more excited. Beginning May 1, we will work out of our new space at 120 Iber Road, Suite 107. This is just a few blocks away from our current location. Although our address will change, all of our other contact information will remain the same.

Our big moving week here at Neff Lafreniere Estate Law has finally arrived. We couldn’t be more excited. Beginning May 1, we will work out of our new space at 120 Iber Road, Suite 107. This is just a few blocks away from our current location. Although our address will change, all of our other contact information will remain the same.

Looking at this weekend’s forecast for Ottawa, I dare say that Mother Nature has finally taken pity on us. Speaking with clients and friends, it seems many of us have already been bitten by the spring cleaning bug despite having to take out our snow shovels earlier this week.

Looking at this weekend’s forecast for Ottawa, I dare say that Mother Nature has finally taken pity on us. Speaking with clients and friends, it seems many of us have already been bitten by the spring cleaning bug despite having to take out our snow shovels earlier this week.

What is a LIRA?

What is a LIRA?

Filing an Estate Information Return has recently been added to an executor’s already long list of duties and responsibilities. The executors (also called estate trustees) I meet with at my law office in the Kanata-Stittsville area of Ottawa have lots of questions about this. Below I will explore the basics of the EIR by answering some of the questions executors have asked me.

Filing an Estate Information Return has recently been added to an executor’s already long list of duties and responsibilities. The executors (also called estate trustees) I meet with at my law office in the Kanata-Stittsville area of Ottawa have lots of questions about this. Below I will explore the basics of the EIR by answering some of the questions executors have asked me.